Capital Gains Tax: A Beginner’s Guide To Unlocking Your Financial Future

Hey there, tax adventurer! If you’ve ever wondered what capital gains tax is or why it matters so much in your financial journey, you’re in the right place. Let’s dive into the world of capital gains tax, where profits meet taxes, and investments get a little complicated—but don’t worry, we’ll break it down in a way that makes sense. Whether you’re a newbie investor or just someone trying to understand how this whole tax thing works, we’ve got you covered.

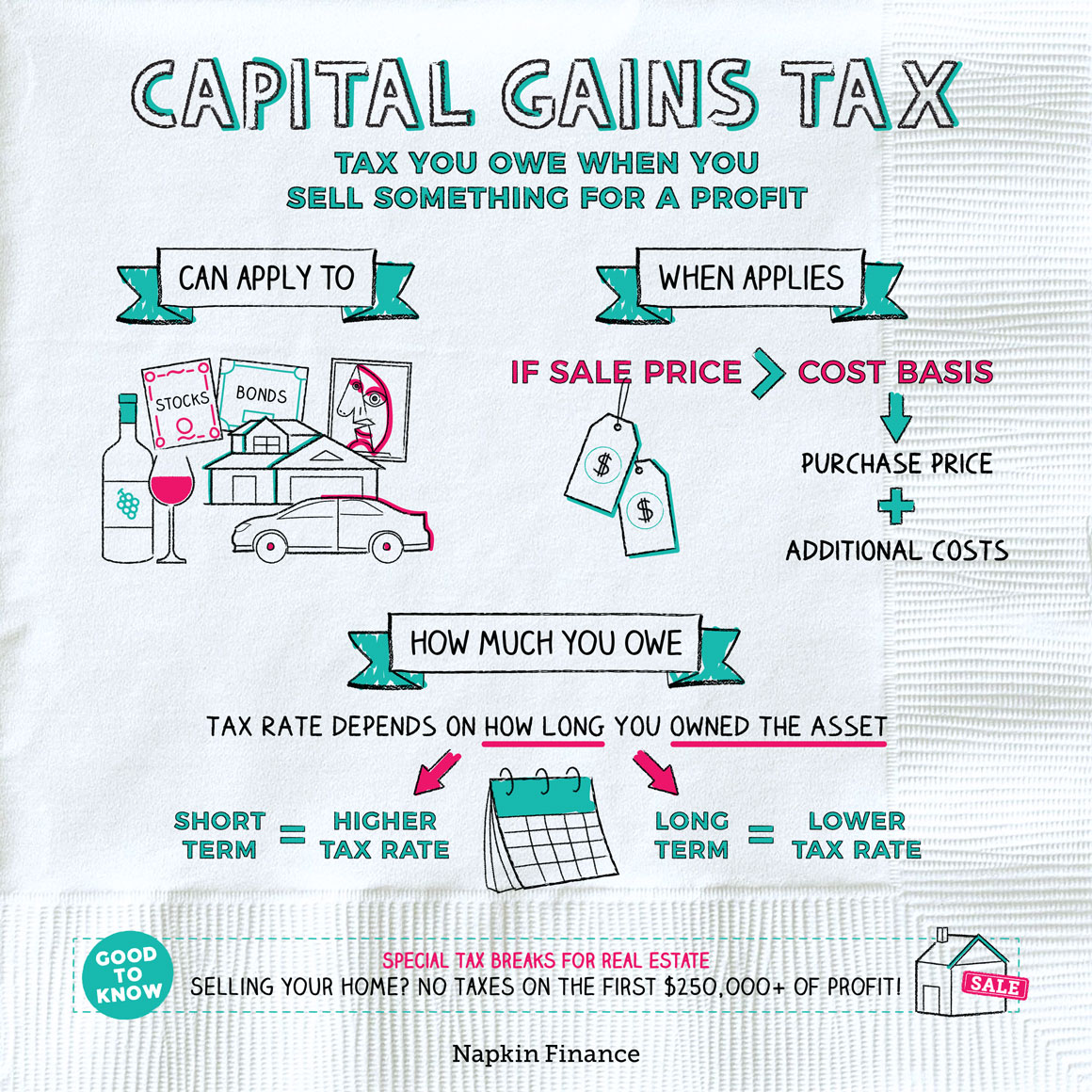

Capital gains tax might sound intimidating, but it’s actually just a fancy term for the tax you pay when you make money from selling something valuable—like stocks, real estate, or even some rare collectibles. Think of it as the government’s way of saying, “Hey, you made a profit, so we want a piece of that pie too!”

Now, before you start panicking about how much of your hard-earned cash goes to taxes, let’s take a deep breath and explore what capital gains tax really is, how it works, and—most importantly—how you can manage it effectively. Ready to roll? Let’s go!

Read also:Bronson Pinchot Says Hersquoll Never Forget What His Idol Lucille Ball Told Him Lsquoi Still Cry Thinking About Itrsquo Exclusive

What Exactly is Capital Gains Tax?

Alright, let’s get to the basics. Capital gains tax is the tax you pay on the profit you earn when you sell an asset. This could be anything from stocks, bonds, real estate, or even that vintage guitar you bought for $50 and sold for $500. The key word here is profit. If you sell something for more than you paid for it, the difference is considered a capital gain, and Uncle Sam wants a cut.

There are two types of capital gains tax: short-term and long-term. Short-term capital gains apply to assets you’ve held for a year or less, and they’re taxed at your ordinary income tax rate. Long-term capital gains, on the other hand, apply to assets held for more than a year, and they’re usually taxed at a lower rate. We’ll talk more about this later, but for now, just know that holding onto your investments longer can save you some serious cash.

Why Should You Care About Capital Gains Tax?

Here’s the deal: if you’re investing or planning to sell any valuable assets, capital gains tax is something you need to understand. Ignoring it can lead to unpleasant surprises come tax season. For example, imagine selling a piece of real estate and thinking you’ve made a killing, only to find out that a big chunk of your profit goes straight to the IRS. Not cool, right?

Understanding capital gains tax isn’t just about avoiding penalties; it’s also about maximizing your returns. By knowing how the tax works, you can strategize your investments, time your sales, and even take advantage of tax breaks. It’s like playing chess with the IRS—except you’re the one making the smart moves.

How Does Capital Gains Tax Work?

Let’s break it down step by step. First, you need to calculate your capital gain. This is done by subtracting your original purchase price (also known as the basis) from the selling price. For example, if you bought a stock for $100 and sold it for $200, your capital gain is $100.

Once you’ve figured out your capital gain, you need to determine whether it’s short-term or long-term. As we mentioned earlier, short-term gains are taxed at your regular income tax rate, while long-term gains are taxed at a lower rate, typically 0%, 15%, or 20%, depending on your income level. And yes, there are some exceptions and nuances, but we’ll get to those later.

Read also:Real Housewives Superfan Anna Faris Would Freak Out If Asked To Guest Star I Like To Hide Behind A Character Exclusive

Key Factors That Affect Capital Gains Tax

Here are a few things that can influence how much capital gains tax you’ll owe:

- How long you held the asset: The longer you hold onto it, the better the tax treatment.

- Your income level: Higher earners pay higher rates on long-term capital gains.

- The type of asset: Some assets, like collectibles, are taxed at a flat 28% rate, regardless of how long you’ve owned them.

- State taxes: Don’t forget that some states also impose their own capital gains tax.

Short-Term vs. Long-Term Capital Gains Tax

Let’s talk about the big difference between short-term and long-term capital gains tax. Short-term capital gains are taxed at your ordinary income tax rate, which can be as high as 37% for the highest earners. Long-term capital gains, on the other hand, are taxed at a much lower rate—usually 0%, 15%, or 20%, depending on your income bracket.

Here’s why this matters: if you sell an asset after holding it for just a few months, you’ll pay a much higher tax rate than if you wait a year or more. So, if you’re thinking about selling an investment, it might be worth holding onto it a little longer to qualify for the lower long-term rate. Just something to keep in mind!

Who Pays Capital Gains Tax?

Not everyone is subject to capital gains tax. Generally, if you sell an asset for more than you paid for it, you’ll owe capital gains tax. However, there are some exceptions:

- Primary residence exclusion: If you sell your primary home, you can exclude up to $250,000 (or $500,000 for married couples) of the gain from taxation.

- Inherited assets: If you inherit an asset, you typically don’t owe capital gains tax on the increase in value that occurred before you inherited it.

- Tax-free accounts: If you sell assets within a tax-advantaged account like a Roth IRA, you won’t owe capital gains tax.

So, while most investors need to pay capital gains tax, there are ways to minimize or even eliminate it altogether. We’ll talk more about those strategies later.

How to Calculate Capital Gains Tax

Calculating capital gains tax might sound complicated, but it’s actually pretty straightforward. Here’s how it works:

- Determine your capital gain by subtracting your basis (original purchase price) from your selling price.

- Classify the gain as short-term or long-term based on how long you held the asset.

- Apply the appropriate tax rate based on your income level and the type of asset.

For example, let’s say you bought a stock for $5,000 and sold it for $10,000 after holding it for two years. Your capital gain is $5,000, and since you held it for more than a year, it’s considered a long-term gain. If you’re in the 22% tax bracket, you’ll pay 15% on that $5,000 gain, which comes out to $750. Easy peasy!

Tips for Simplifying the Calculation

Here are a few tips to make the calculation process smoother:

- Keep detailed records of all your transactions, including purchase and selling prices, dates, and any fees or commissions.

- Use tax software or consult with a tax professional to ensure accuracy.

- Consider using a tax calculator to estimate your capital gains tax liability.

Strategies to Minimize Capital Gains Tax

Now for the fun part: how to reduce your capital gains tax bill. Here are a few strategies to consider:

- Hold onto assets longer: As we’ve discussed, long-term capital gains are taxed at a lower rate, so holding onto your investments for more than a year can save you money.

- Take advantage of tax-loss harvesting: If you have investments that have lost value, you can sell them to offset your capital gains and reduce your tax liability.

- Invest in tax-advantaged accounts: Accounts like IRAs and 401(k)s allow you to defer or eliminate capital gains tax altogether.

- Consider municipal bonds: These are often exempt from federal and state taxes, making them a great option for reducing your overall tax burden.

By implementing these strategies, you can keep more of your hard-earned money and reduce the amount you owe in capital gains tax.

Common Misconceptions About Capital Gains Tax

There are a few common myths about capital gains tax that we need to clear up:

- Myth #1: All gains are taxed the same: Nope! As we’ve seen, short-term and long-term gains are taxed differently, and some assets, like collectibles, are taxed at a flat rate.

- Myth #2: You only owe capital gains tax if you make a profit: Actually, you can use losses to offset gains, so even if you don’t make a profit, you can still reduce your tax bill.

- Myth #3: Capital gains tax is unavoidable: With the right strategies, you can minimize or even eliminate your capital gains tax liability.

Knowing the facts can help you make smarter financial decisions and avoid costly mistakes.

Real-Life Examples of Capital Gains Tax

Let’s look at a couple of real-life examples to see how capital gains tax works in practice:

Example 1: Sarah bought a rental property for $200,000 and sold it five years later for $300,000. Her capital gain is $100,000, and since she held the property for more than a year, it’s considered a long-term gain. If Sarah is in the 22% tax bracket, she’ll pay 15% on the gain, which comes out to $15,000.

Example 2: John bought 100 shares of a stock for $50 each and sold them six months later for $75 each. His capital gain is $2,500, and since he held the shares for less than a year, it’s considered a short-term gain. If John is in the 32% tax bracket, he’ll pay 32% on the gain, which comes out to $800.

These examples show how the length of time you hold an asset and your income level can significantly impact how much capital gains tax you owe.

Lessons Learned from Real-Life Cases

From these examples, we can see that:

- Holding onto assets longer can result in significant tax savings.

- Higher income levels mean higher tax rates, so it’s important to manage your investments accordingly.

- Understanding the rules can help you make informed decisions and avoid unnecessary taxes.

Conclusion: Take Control of Your Capital Gains Tax

And there you have it, folks—a comprehensive guide to capital gains tax. Whether you’re a seasoned investor or just starting out, understanding how capital gains tax works is essential for maximizing your returns and minimizing your tax liability.

Remember, capital gains tax doesn’t have to be scary. With the right strategies and a little bit of knowledge, you can take control of your financial future and make smart investment decisions. So, go ahead and start planning your next move—your wallet (and your accountant) will thank you!

Before you go, don’t forget to leave a comment or share this article with your friends. And if you’re looking for more tips on managing your finances, be sure to check out our other articles. Happy investing!

Table of Contents

- What Exactly is Capital Gains Tax?

- Why Should You Care About Capital Gains Tax?

- How Does Capital Gains Tax Work?

- Short-Term vs. Long-Term Capital Gains Tax

- Who Pays Capital Gains Tax?

- How to Calculate Capital Gains Tax

- Strategies to Minimize Capital Gains Tax

- Common Misconceptions About Capital Gains Tax

- Real-Life Examples of Capital Gains Tax

- Conclusion: Take Control of Your Capital Gains Tax

Article Recommendations